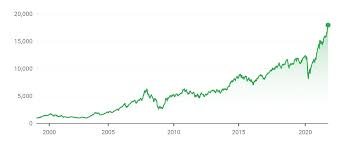

The Indian stock market(Nifty 50) experienced a remarkable rally on June 3, 2024, driven by positive exit poll results for the Lok Sabha elections. Both the Nifty 50 and Sensex indices witnessed substantial gains, reflecting heightened investor confidence and a bullish outlook for the near future. This blog delves into the details of this market rally, the factors driving it, and the broader implications for investors.

Nifty 50 Performance

The Nifty 50 index saw a significant rise, ending the trading day at a considerably higher level. This rally was propelled by robust buying activity across various sectors, indicating widespread optimism among market participants. Key sectors such as Information Technology (IT), banking, and consumer goods led the charge, contributing majorly to the overall performance of the index.

Exit Poll Impact

The exit polls, which indicated a favorable outcome for the incumbent government, were a major catalyst for the market’s upward movement. Investors interpreted these results as a sign of political stability, expected to translate into continued economic reforms and favorable policies. This sentiment was evident as the Sensex and Nifty 50 both surged by over 3%, resulting in a massive addition of Rs 14 lakh crore to investors’ wealth.

Sectoral Insights

Information Technology (IT) Sector:

IT stocks were among the top gainers during the trading session. Companies like TCS and Infosys saw their share prices rise significantly, driven by strong quarterly earnings and positive global cues. The IT sector’s performance is often seen as a barometer of global economic health, and its strong showing boosted overall market sentiment.

Banking Sector:

The banking sector also experienced notable gains, with major banks reporting strong financial health and stable asset quality. Stocks of leading banks such as HDFC Bank and ICICI Bank surged, reflecting investor optimism about the sector’s prospects under a stable government. The expectation of continued economic reforms and policy support for the banking sector further bolstered investor confidence.

Consumer Goods Sector:

Consumer goods companies gained traction as well, buoyed by expectations of stable governance boosting consumer confidence. Firms like Hindustan Unilever and ITC saw their stock prices rise, driven by the anticipation of sustained consumer demand and favorable economic policies.

Investor Sentiment

The positive exit poll results have significantly bolstered investor sentiment. The market’s strong performance is a reflection of the heightened optimism among investors, who are now more confident about the country’s economic prospects. The pro-reform government projected by the exit polls has driven expectations of policy continuity, seen as critical for sustaining economic growth.

Investors were particularly bullish following the exit polls, leading to increased trading volumes and widespread buying across sectors. This surge in market activity has created a favorable environment for both retail and institutional investors, encouraging them to increase their market participation.

Future Outlook

While the current market(Nifty 50) rally is driven by positive sentiment following the exit polls, the actual election results will be crucial in determining the future trajectory of the market. If the final results align with the exit polls, the market could see further gains. However, any deviation from the expected outcomes could lead to increased volatility and prompt a reassessment of market positions.

Key Considerations for Investors

Political Developments:

The actual election results, expected to be announced soon, will play a pivotal role in shaping the market’s future direction. A stable government is likely to continue with economic reforms and policies that have driven growth in recent years. However, any unexpected political developments could introduce uncertainty and volatility into the market.

Economic Policies:

Post-election, investors will closely monitor the government’s policy directions. Key areas of focus will include fiscal policies, infrastructure development, and reforms in critical sectors like agriculture, manufacturing, and technology. Effective implementation of these policies will be essential for sustaining the current market rally and driving long-term growth.

Global Factors:

Global economic conditions and geopolitical developments will also significantly influence the market’s future. Factors such as the US Federal Reserve’s interest rate decisions, trade dynamics, and geopolitical tensions will need to be watched closely. Positive global cues could further enhance market sentiment, while adverse developments might pose challenges.

Domestic Influences:

Domestically, factors like inflation rates, corporate earnings, and monsoon forecasts will influence market trends. The interplay of these factors with policy measures will determine the overall economic environment and market performance in the coming months.

Conclusion

The recent rally in the Indian stock market(Nifty 50), driven by positive exit poll results, underscores the importance of political stability and investor confidence in shaping market dynamics. As the market awaits the actual election results, the focus will remain on policy continuity and economic reforms. The performance of key sectors, coupled with global and domestic economic factors, will continue to influence market trends and investor sentiment.

Pingback: Gun Bump Stocks: Controversial Supreme Court Ruling on Gun Bump Stocks - June 14th 2024

Pingback: Donald Trump Turns 78: Celebrating the Maverick Who Shook the World