The Investing App Military Families Love for Its Simplicity

Wall Street banks prefer clients with millions — if not billions — to invest. Soldiers, nurses and construction workers typically aren’t anywhere near that wealthy.

Wall Street banks typically prioritize clients with substantial wealth—millions or even billions to invest. But for soldiers, nurses, and construction workers, that level of wealth is often far out of reach.

Enter Stash, a popular investing app that allows users to start with as little as $5. Branded as “investing for real people,” Stash has grown rapidly by catering to those traditionally ignored by big financial institutions.

Stash’s Appeal to Military Families

Since its launch last fall, Stash has attracted over 150,000 users, with about 10% of them being active-duty military personnel. This is notable given that less than half a percent of the U.S. population currently serves in the armed forces.

“Many of our users begin investing with less than $100, and that’s fantastic because they’ve taken the first step towards building their financial future,” says Brandon Krieg, co-founder and CEO of Stash. The app provides a gateway for people to learn about investing and start small, making it an accessible option for many Americans.

A Simple Approach to Investing

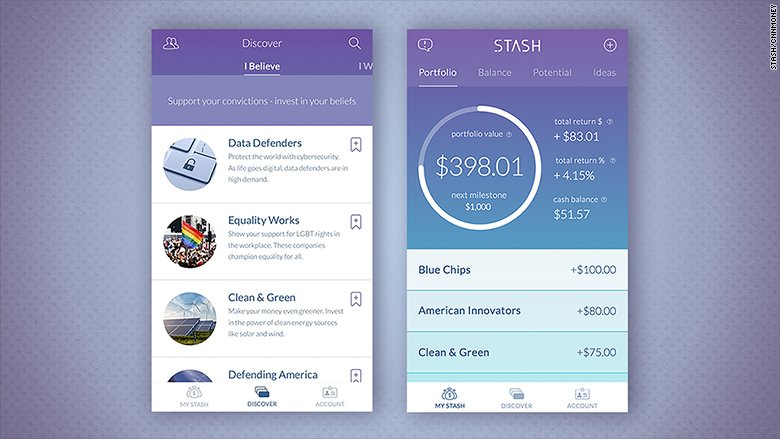

Stash has made investing straightforward by offering just 33 investment options. This simplicity is appealing, especially when compared to the overwhelming array of thousands of stocks and funds available through traditional brokers.

Unlike “roboadvisor” apps such as Wealthfront and Betterment, where algorithms make investment decisions for you, Stash puts control in the hands of its users. The app offers guidance, but ultimately, you choose where to invest your money. This approach helps users learn the ropes of investing rather than passively handing over their financial decisions to a machine.

Popular Among Gig Workers and First-Time Investors

In addition to military families, Stash is a hit with self-employed individuals, including Uber drivers. The app caters to first-time investors, offering an easy-to-navigate platform for people who have never invested before.

“Financial literacy in this country is a huge issue,” Krieg told CNNMoney. Stash is also rolling out a new feature called “learn,” designed to further educate users and improve their investment skills.

Customizing Your Investment Portfolio

When users sign up, the app asks a few basic questions to assess whether they prefer low, medium, or high-risk investing. Most people land in the middle and are encouraged to invest in the “Moderate Mix” fund—a solid choice that balances growth potential with stability, ideal for long-term goals like retirement or college savings.

Other available funds include “Internet Titans,” “Defending America,” and “Clean & Green.” These funds focus on different sectors but are named in a way that makes them easy to understand, steering away from complex Wall Street terminology.

Affordable, but Watch the Fees

While Stash is praised for making investing accessible, users should be mindful of fees. The app charges $1 per month, which can eat into returns if you’re investing smaller amounts. It’s recommended to invest at least $250 to ensure the fees remain minimal compared to potential gains.

Stash’s Growing Success

Stash has already made a significant impact, and the company continues to evolve. Recently, it raised $9.25 million in a Series A funding round led by Goodwater Capital, signaling even more growth and new features in the coming months.