Pimco’s Assets Drop Below $100 Billion Post-Gross Era

Pimco’s Decline Post-Bill Gross

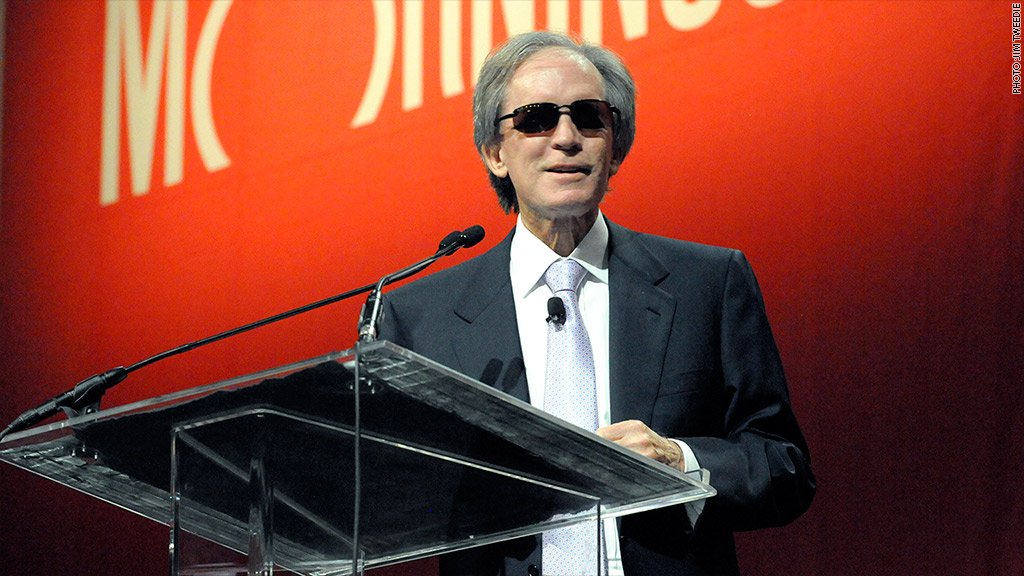

Once a titan in the bond fund world, Pimco has seen its assets plummet below $100 billion—a striking shift since founder and “bond king” Bill Gross left nearly a year ago. Gross’s departure triggered significant investor withdrawals, leading to an ongoing decline that has brought Pimco’s assets to their lowest level since 2007.

Impact on Pimco’s Total Return Fund

In August alone, Pimco’s Total Return Fund, once Gross’s flagship fund, saw $1.8 billion in withdrawals. The fund, now managing less than $100 billion, pales in comparison to its peak of $293 billion in 2013, marking a sharp decline as Vanguard surpassed Pimco to become the largest bond fund manager globally.

Gross’s Departure and Pimco’s Identity Crisis

Pimco’s struggle highlights the risk of tying a brand too closely to one individual. Gross, an icon of the bond market, shaped Pimco’s image and direction for years. After clashing with other executives over management style, Gross left Pimco for Janus Capital Group in September last year, triggering even larger outflows from an already struggling fund.

The Role of New Leadership

In a bid to strengthen its position, Pimco recently appointed former Federal Reserve Chair Ben Bernanke as an adviser. However, this high-profile addition has yet to turn around Pimco’s trajectory.

Bwer Company is a top supplier of weighbridge truck scales in Iraq, providing a complete range of solutions for accurate vehicle load measurement. Their services cover every aspect of truck scales, from truck scale installation and maintenance to calibration and repair. Bwer Company offers commercial truck scales, industrial truck scales, and axle weighbridge systems, tailored to meet the demands of heavy-duty applications. Bwer Company’s electronic truck scales and digital truck scales incorporate advanced technology, ensuring precise and reliable measurements. Their heavy-duty truck scales are engineered for rugged environments, making them suitable for industries such as logistics, agriculture, and construction. Whether you’re looking for truck scales for sale, rental, or lease, Bwer Company provides flexible options to match your needs, including truck scale parts, accessories, and software for enhanced performance. As trusted truck scale manufacturers, Bwer Company offers certified truck scale calibration services, ensuring compliance with industry standards. Their services include truck scale inspection, certification, and repair services, supporting the long-term reliability of your truck scale systems. With a team of experts, Bwer Company ensures seamless truck scale installation and maintenance, keeping your operations running smoothly. For more information on truck scale prices, installation costs, or to learn about their range of weighbridge truck scales and other products, visit Bwer Company’s website at bwerpipes.com.

Serving Iraq with pride, BWER supplies high-performance weighbridges designed to improve transport logistics, reduce inaccuracies, and optimize industrial processes across all sectors.